In the modern business world, efficient financial management is critical. One of the critical aspects of this financial management is bank reconciliation, a process that ensures that your company’s financial records accurately reflect your bank statements.

Odoo the all-in-one business management software, provides versatile ERP software, and bank reconciliation has been making financial management easier and more efficient than ever.

Bank Reconciliation:

Odoo provides the feature of bank reconciliation which saves time, and manual work which can lead to inaccurate data also. In Odoo 17 all the customer invoices, vendor bills, and payments had the journal entry, but the payment status remains “In Payment” as it has not been reconciled with the bank statement. To get accurate data the company financial report and the bank statements should matched.

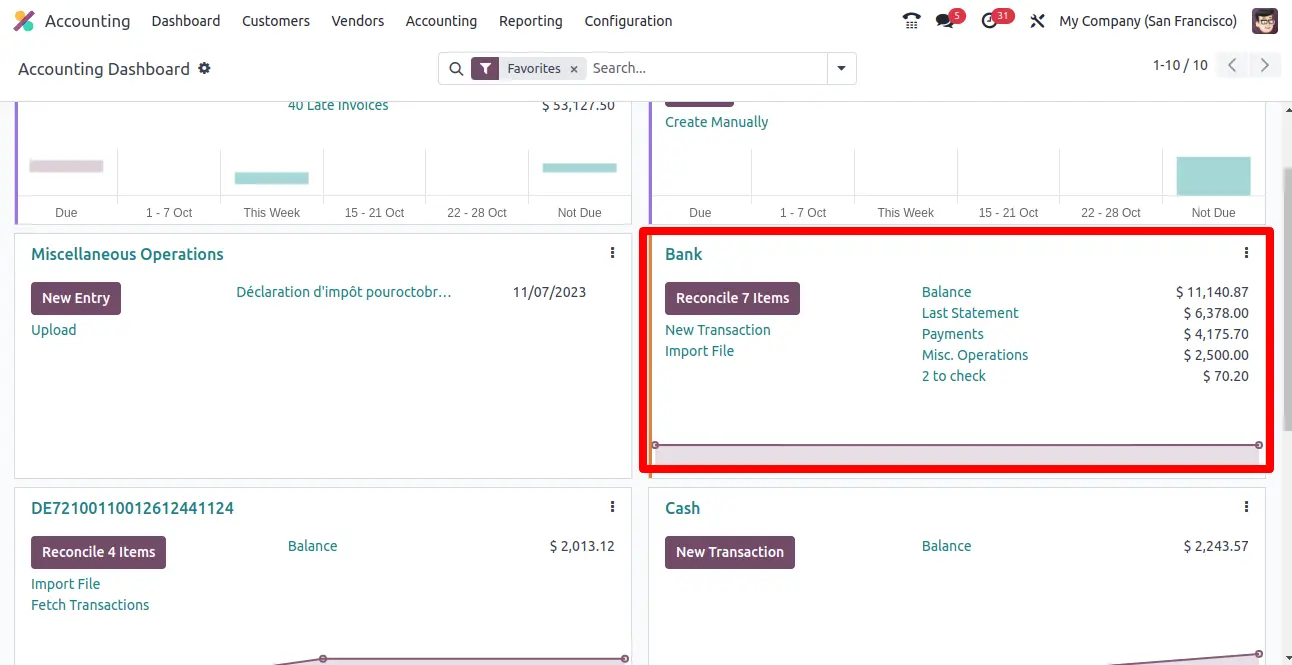

In the accounting dashboard, the user gets an overview of their bank balance, bank statement, and all the Reconciled Items that need to be reconciled with the remaining number of reconciled, number of entries to check.

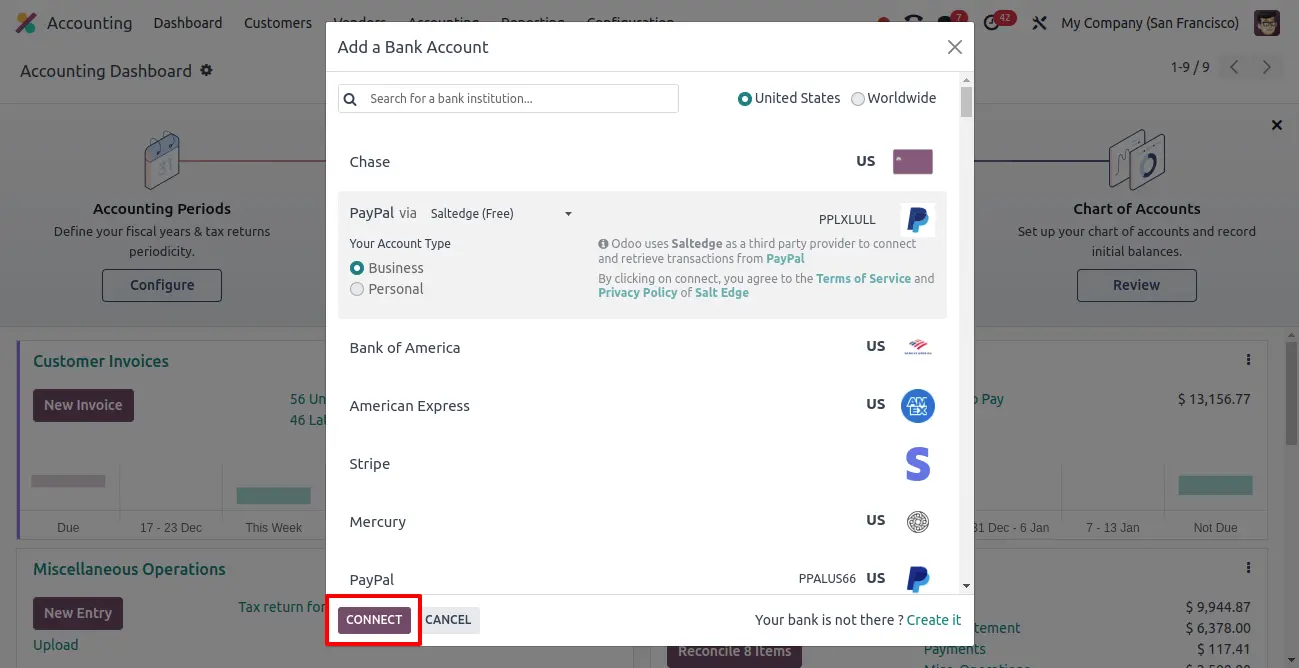

For synchronization of the Bank with Odoo:

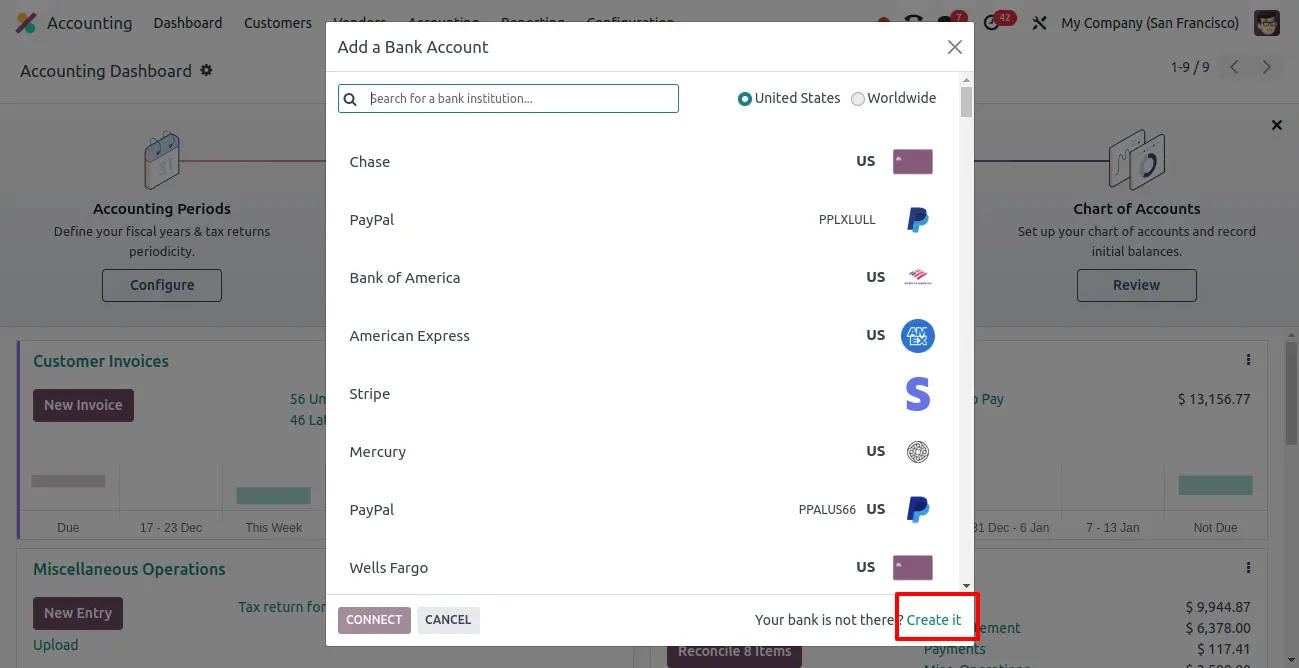

Go to Accounting -> Configuration -> Under Bank Menu -> Add a Bank Account

Select your bank in the list, click on Connect, and follow the instructions.

If you don’t find your bank in the Bank list, then you can manually connect odoo with your bank then

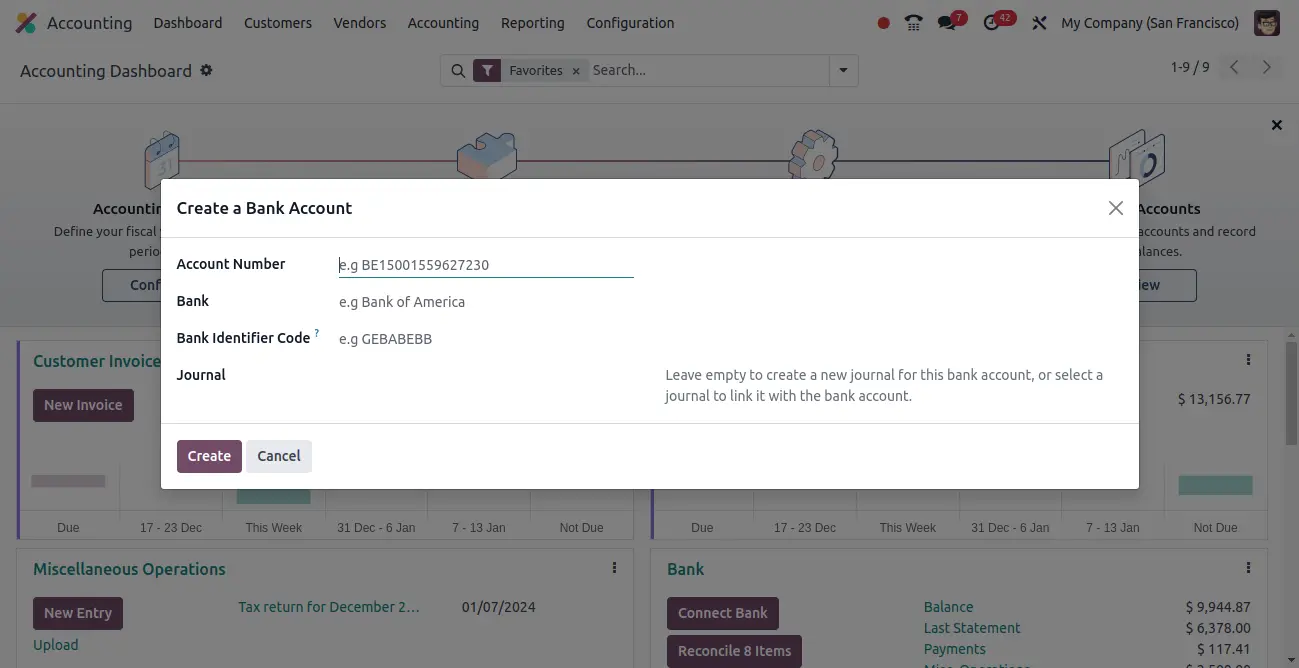

Go to Accounting -> Configuration -> Banks: Add a Bank Account, click on Create it.

Fill in your bank details and click Create.

Odoo automatically calculates and displays the number of pending reconciled entries in the dashboard.

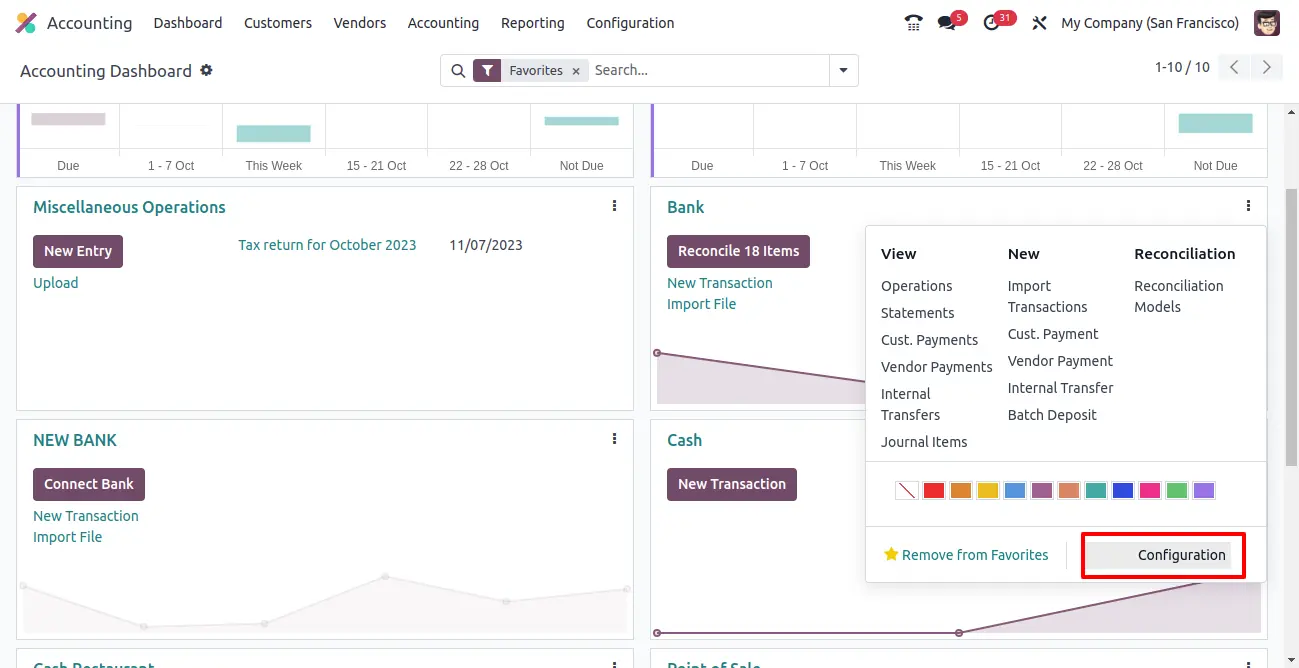

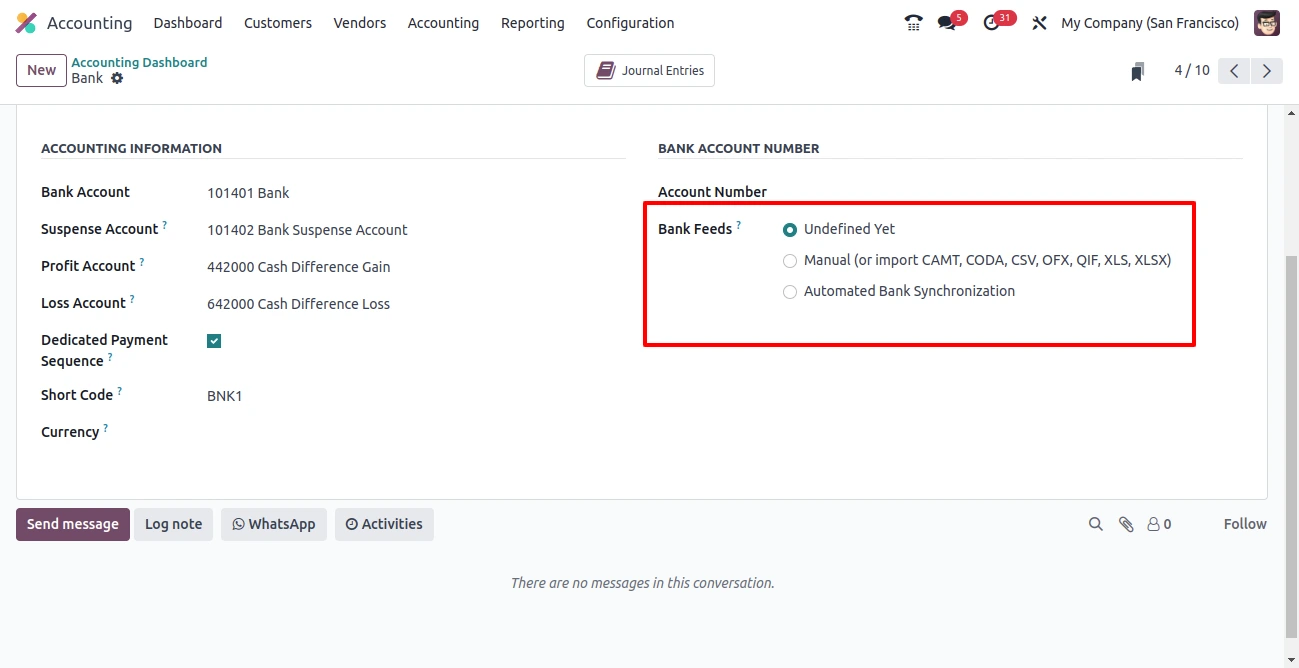

Users can configure the dashboard data for the bank to Automated Bank Synchronization, Manual, or both.

Go to Accounting -> Dashboard -> Bank (Jornal Card)->Click on three dots -> Configuration.

In Bank Feeds option:

In Automated bank synchronization it will update the bank statements line automating.

In Manual users can manually create bank statement entries or import CAMT, CODA, CSV, OFX, QIF, XLS, and XLSX files.

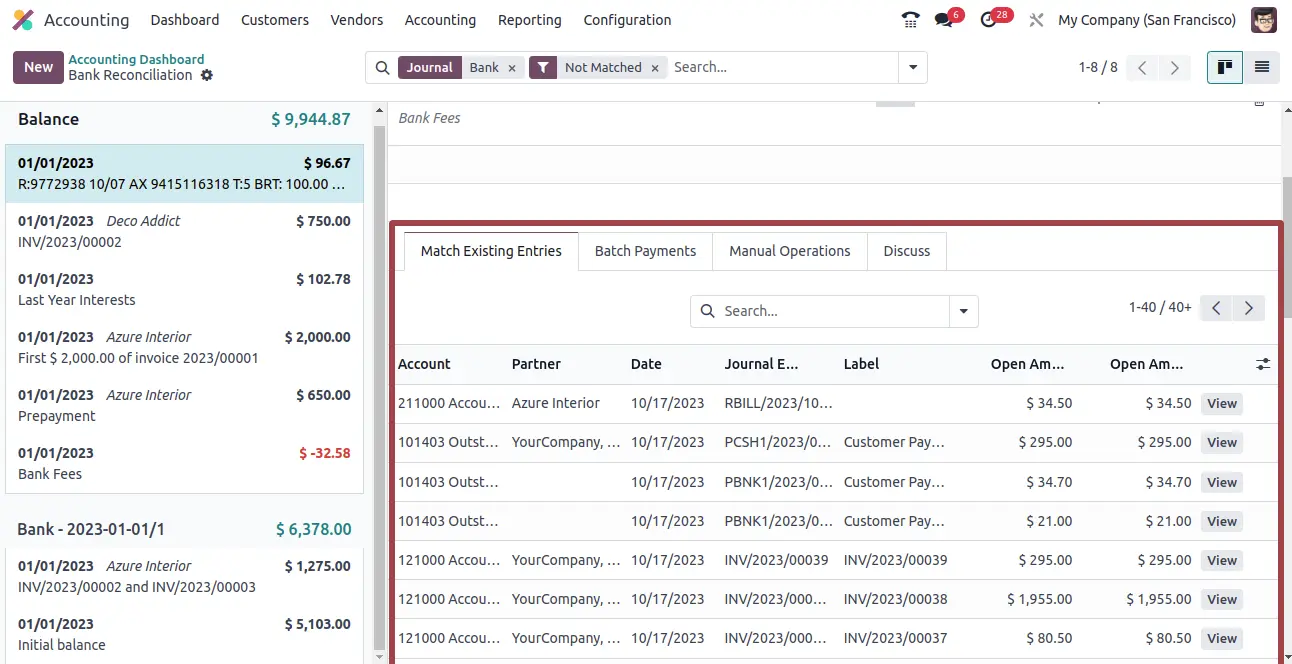

Bank Reconciliation view

Click on the Reconciliation items Button in the dashboard.

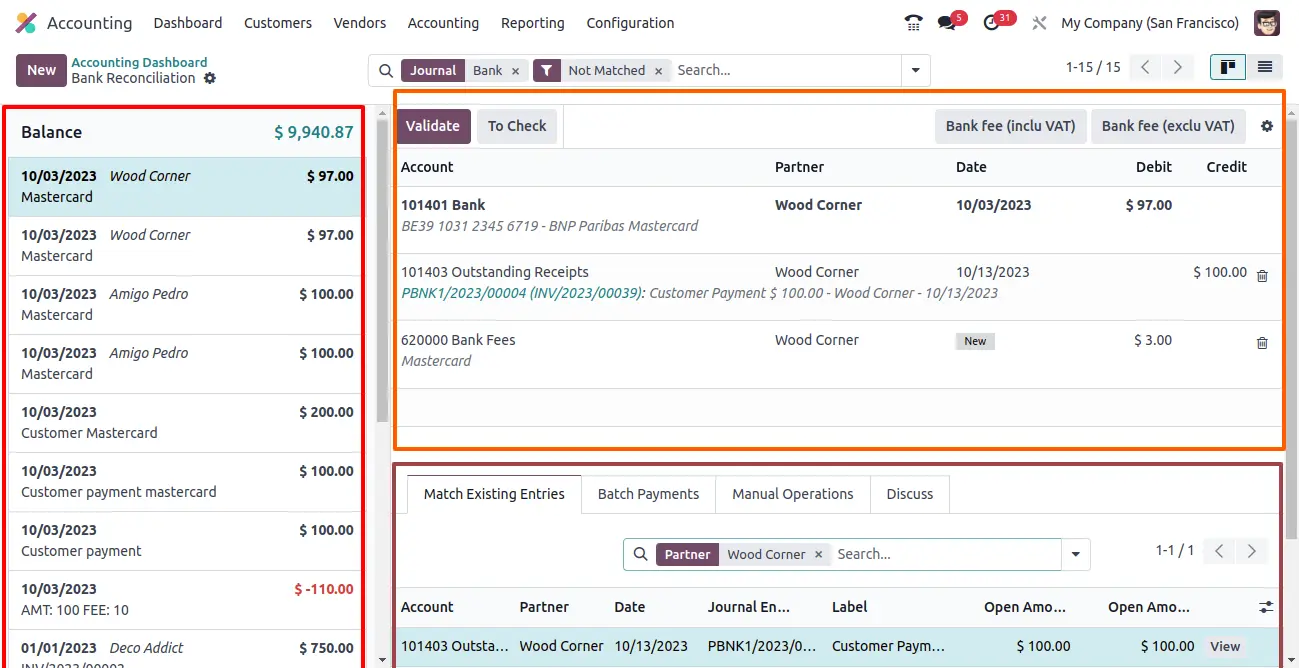

The Left Section of the bank reconciliation view content:

List of Bank Statements: The Bank Reconciliation view displays a list of bank statements. You can select a specific bank statement to reconcile by default it displays the latest transaction.

Statement Lines: Within a selected bank statement, you'll see a list of statement lines. Each line represents a transaction from your bank statement, including deposits, withdrawals, etc.

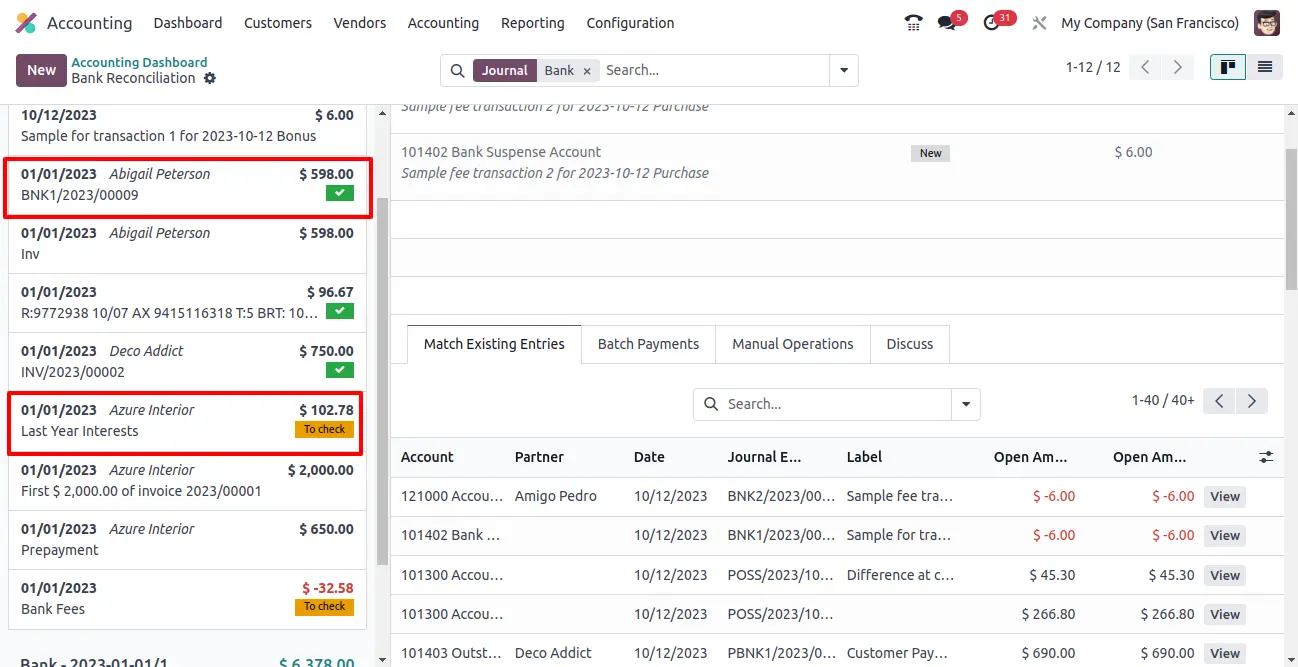

The default Filter is NOT Matched which shows all pending reconcile but by removing the filter in bank statement lines user can view the Reconciliation status too.

Reconciliation Status: Each statement line has a reconciliation status, indicating whether it's reconciled, not reconciled, or needs to check the entry. Reconciled transactions are those where the bank statement matches accounting records.

The right section divided into two parts:

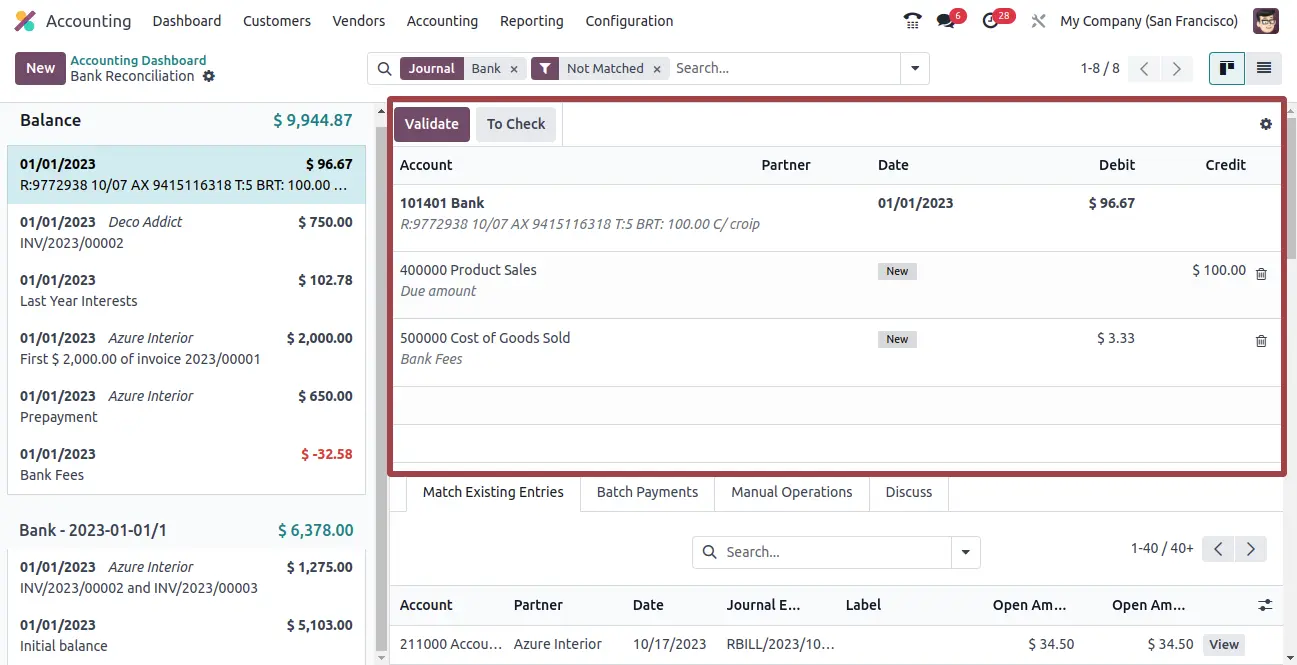

Matching Transactions:

Users can manually match the statement lines with the accounting entries. Odoo provides tools to help you identify matching transactions based on criteria such as reference numbers, dates, and amounts.

Automatic Matching: Odoo offers automatic matching features that attempt to reconcile transactions based on predefined rules in the reconciliation model. This can save time by automating the reconciliation process for certain types of transactions.

Accounting Entries:

For each statement line, Odoo displays the corresponding accounting entries from your accounting system.

Discuss: Odoo provides a feature for internal communication between accounting teams.

Manual Operations: The user can also manually reconcile.

Batch Payment: In the Batch Payment tab, Odoo displays all the batch payments also known as bulk payments or mass payments, allowing you to group multiple payment transactions for reconciliation with your bank statement. This is particularly useful when you have many payment transactions to reconcile at once.

Conclusion

Bank reconciliation is a critical financial process for any business. This process is made more efficient and user-friendly than ever before, offering advanced features like automatic matching, customization, and real-time synchronization. By using Odoo for bank reconciliation, businesses can ensure the accuracy of their financial records.